Call: 541-247-8101

Follow Us

Is Your Company’s Profit “Planned For” or is it “Hoped For”?

Small business owners wear many different hats in their business. While this is good in that a small business owner knows best how to produce, sell, or market their product or service, the problem is that their financial ability hat is usually worn very little. Most small business owners are weak at understanding the financials of their business. They often make decisions based only upon the amount of funds in their bank accounts. Running a business solely upon what’s in your bank account eventually leads to problems.

Financial Expertise

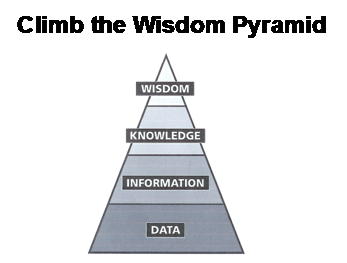

Financial Wisdom

Take your current financial understanding to the next level with On Target Tax & Accounting. We will help you gain financial wisdom concerning your business. With financial wisdom, you will more easily make and understand decisions that help ensure more profit. Where on the Wisdom Pyramid are you?

Allows You to Focus On What You Do Best

There are only so many hours within a day, and far too few for most small business owners. The qualified assistance of On Target Tax & Accounting helps free up more of your time to focus on what you do best. Let our financial experts become a part of your team to help grow the profits in your business.

Call On Target Tax & Accounting and learn how we can help you become more profitable.